The rising cost-of-living is placing pressure on everyone, but university students are more vulnerable than most. (image: Jasmyn Evans)

By Jasmyn Evans | @jasmyn.evans

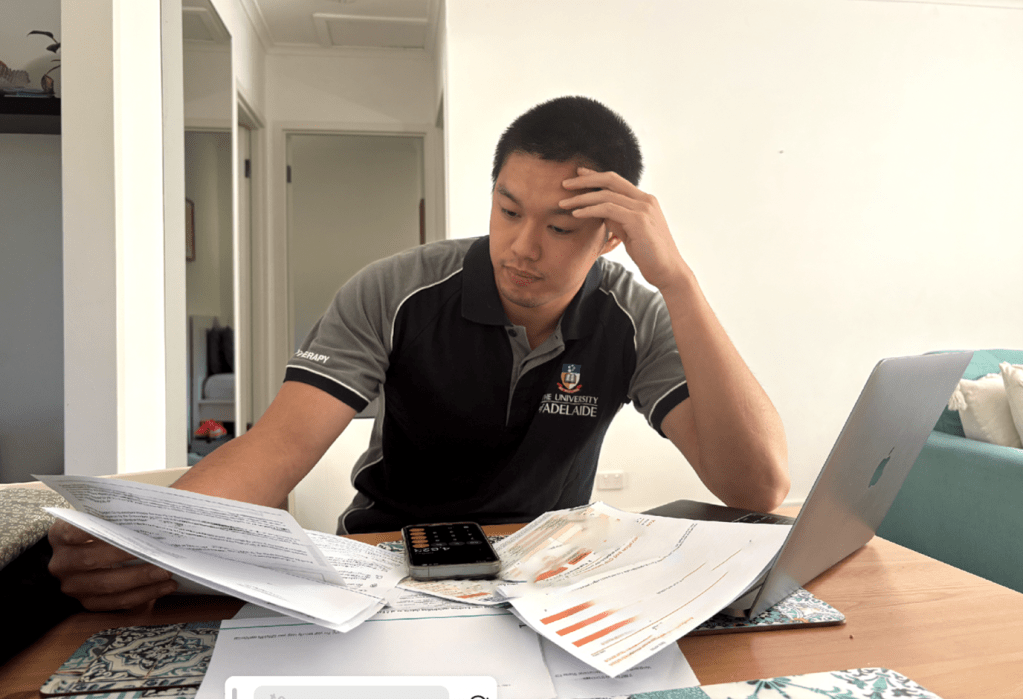

Being a university student in Australia is not just lectures and late-night study sessions; for thousands of students, it’s a daily struggle against financial hardship. With the rising cost of living being felt nation-wide, tertiary students are among those most weighed down by the pressure.

The latest student finances survey by Universities Australia found one third of university students estimated their expenses were greater than their income and 58 per cent of students were worried about their financial situation.

The survey also found 82 per cent of students undertook paid work on top of university, and one in ten students deferred their studies because they could not afford to continue.

These situations are all too familiar for undergraduate students Hudson Knox and Gabriel Lim, as well as apprentice Ryan Pearsons.

Bachelor of Journalism and Professional Writing

Three-year degree

Expected HECS debt: $45,000

Average annual salary post degree: $74,000

Bachelor of Physiotherapy (Honours)

Four-year degree

Expected HECS debt: $34,000

Average annual salary post degree: $82,000

First year carpentry apprentice

Four-year apprenticeship

HECS debt: $0

Average annual salary post apprenticeship: $80,000

Left and centre image: Jasmyn Evans. Right image: supplied.

In his final year of study at the University of South Australia (UniSA), Knox has watched his Higher Education Contribution Scheme Higher Education Loan Program (HECS-HELP) debt climb steadily over the past three years.

“I had no idea it was going to cost so much just to do uni,” Knox says.

Knox’s degree falls into a range of study areas that received a more than 100 per cent price increase under the Federal Coalition government back in 2021. Degrees that were considered “in demand”, such as teaching and nursing, were made cheaper for future students.

“Having a $45,000 HECS debt for a three-year course is insane,” Knox says.

“Not to mention how it gets, like, indexed or whatever every year and more money gets added on.

“I do seriously wonder how I’ll manage to pay that off in the future.”

Knox works a casual job at Kmart on top of his full-time study to pay for his current living expenses. He admits he’s probably better off than most students because he still lives at home.

“I’m lucky because I still live with my mum,” Knox says.

“I don’t have to pay rent or any bills like a lot of my friends and other students do.

“I’ll probably stay with mum as long as I can. Definitely at least until I graduate and start getting a full-time income. It just takes the pressure off.”

University of Adelaide physiotherapy student Gabriel Lim bears the full brunt of the cost-of-living crisis, having moved out of home earlier this year and supporting himself entirely.

“Money is something that really plays on my mind,” Lim says.

“I’ve got electricity bills, rent, gas, gym fee, Wi-Fi, my phone plan, Spotify, and they’re just my regular bills. That’s not to mention groceries and fuel, and things like parking or unexpected expenses.”

For students like Lim, things aren’t likely to get easier anytime soon. UniSA Credit Union Chair of Economics Dr Susan Stone says current prices are likely to stick around.

“The surge in demand after COVID, together with the need to ramp up business production again, caused the spike [in inflation] we’ve witnessed lately,” Stone says.

“So, for students, current price levels are likely here to stay, but the constant increases seem to be under control.”

Lim supplements his studies by working casually as an allied health assistant at Flinders Medical Centre. His hours, though, are few and far between due to long blocks of full-time placement.

“As a fourth-year physio student, we do five blocks of five-week placements: full time and unpaid,” Lim says.

“It totals to over 1,000 hours for the whole degree, all unpaid.”

These lengthy hours put further strain on Lim’s financial situation, and he’s not alone.

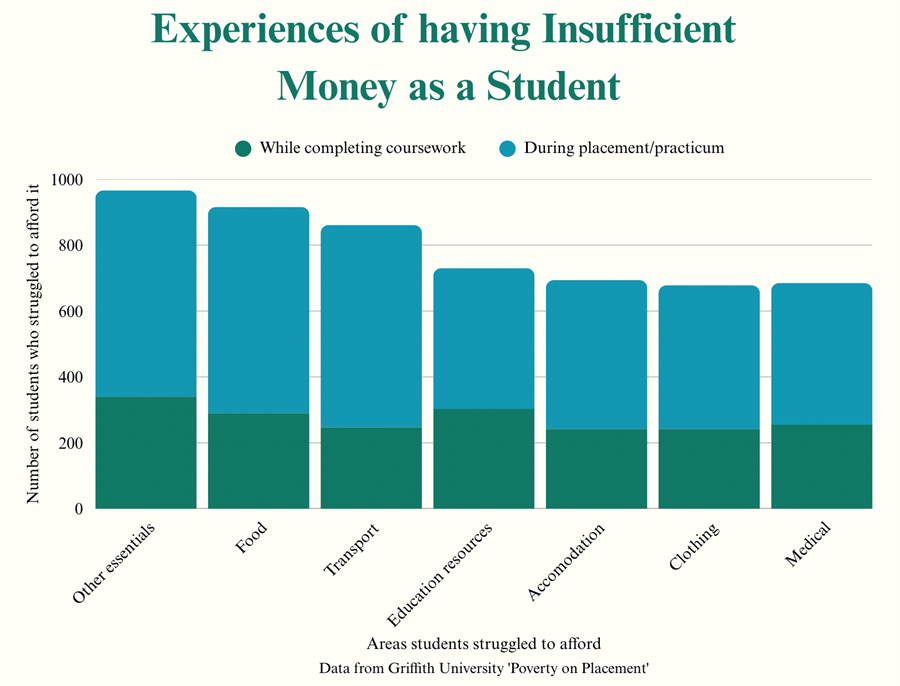

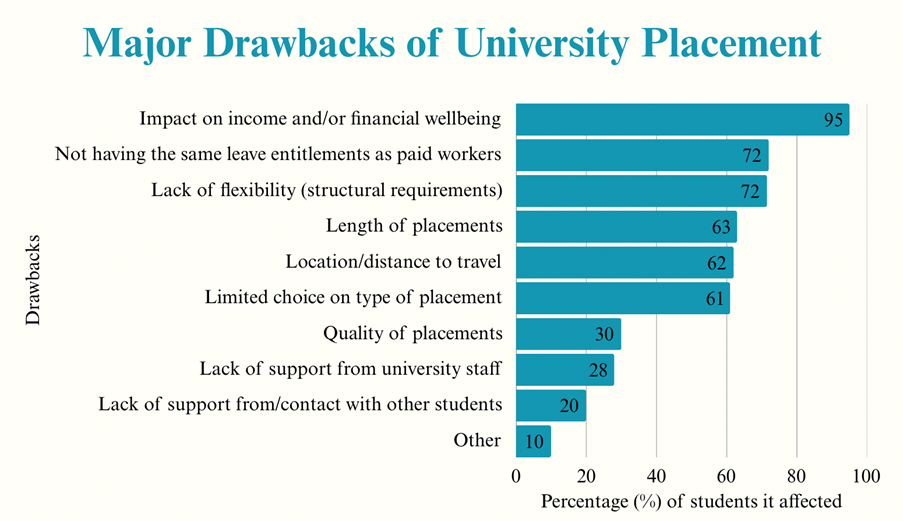

A 2024 report by Griffith University found over 98 per cent of responding students were adversely affected by financial difficulties during placement. Ninety-three per cent reported that unpaid placements were detrimental to their stress levels.

“Placement is very stressful,” Lim says.

“With my placement, you’re getting marked on every single thing you do. So, you’re being marked the whole time you’re at placement. That’s already an increased stress level, and with no compensation for that except for passing.

“You’re working full-time hours, and then further preparation at home as well. It’s not like you just do placement and that’s it.

“In the moment it feels like a, I don’t know, a pretty heavy-handed transaction.”

The report found over 99 per cent of students called for paid placements or financial support to help address student poverty and wellbeing, with 96.5 per cent reporting a loss of regular income during unpaid placements.

The average income reduction during placement was 78 per cent, while 80 per cent of students reported a significant increase in expenses during this time. Almost half the responding students had a complete loss of income.

“[After placement] you have to come home and worry about what you’re going to eat and what you’re going to do [about money],” Lim says.

“Life doesn’t stop just for placement.”

Data taken from Griffith University’s Poverty on Placement report 2024 (Image: Jasmyn Evans).

Griffith University also found placement affected students’ general health and wellbeing. Seventy-six per cent of respondents said it affected their sleep and 77 to 87 per cent experienced difficulties meeting basic living costs during placement periods.

“Because placement is so full-on, and then I have all these other things to worry about, I don’t get time to do the things that usually help me de-stress,” Lim says.

“I think that has a big impact for me.”

The mental and financial hardships faced by students has become a reason for many young people to avoid university altogether.

Data from the 2022 Higher Education Student Statistics found there was a 10.4 per cent decrease in the number of domestic students commencing university in 2022 compared to 2021. The 2023 statistics show a further 1.8 per cent decrease in 2023.

This decrease comes from young school-leavers pursuing careers that allow them to enter the workforce straight from school, such as a job in construction.

According to a Labour Force release from the Australian Bureau of Statistics, employment in construction is steadily on the rise. In February 2025, there had been a 3.7 per cent growth in employment over the last year.

First year carpentry apprentice Ryan Pearsons is one of the many young people who decided against attending university and entered the trades after finishing high school in 2023.

For Pearsons, earning money straight out of school and not having to study were big contributors to why he chose carpentry over tertiary study.

“I reckon maybe early high school I did [consider university] a little bit, but then I couldn’t imagine myself doing more school,” he says.

“I just wanted to get a job straight away once I finished school and, yeah, just start making money.

“I get paid weekly. The money is not awesome, but I manage. It’s not too bad as long as I make sure I know what I’ve gotta pay for and stuff and money is fine.”

What is being done to combat the financial hardship faced by tertiary students?

The Australian Government is set to reduce student loan debt by 20 per cent in the coming months.

This one-off reduction will take financial pressure off Australians with a HECS-HELP debt, allowing them to save for events such as buying a home and starting a family.

While the 20 per cent reduction means less for students to pay off, it has no immediate relief for current students trying to survive the cost-of-living crisis.

“I’m glad the debt will go down, but it really doesn’t help us at all right now,” Knox says.

There is also fresh hope for arts and humanities students, with over 100 high-profile Australians signing an open letter to Prime Minister Anthony Albanese, urging him to abolish the Jobs-Ready Graduate scheme.

The letter, written by the Australian Historical Association, expresses concern about the lack of opportunities young Australians have to pursue Bachelor of Arts degrees and encourages a new fee regime that does not financially punish students who choose to pursue this area of study.

There had not been a response from Albanese or the government at the time of publication.

The Australian Government announced in the 2024–25 Budget it would establish the Commonwealth Prac Payment (CPP) program, with the aim to support higher education and VET students undertaking mandatory placements.

The program means domestic students undertaking a mandatory placement in nursing, midwifery, teaching or social work degrees may be able to access $331.65 per week as of July 1.

The limited reach of this new program has received criticism by a range of groups that advocate for students, such as the Australian Psychological Society, The Pharmacy Guild of Australia and The Australian Veterinary Association, who call for their respective degrees to be included in the program.

The government acknowledged the challenges faced by students in other degrees but has not announced plans to expand the CPP to other disciplines as of publication.

For students Knox and Lim, whose degrees are not eligible for the CPP, this means things won’t get any easier.

“I think it’s unfair,” Lim says.

“I think the two biggest courses that have placements are medicine and physiotherapy and [the placements] are unpaid.

“I feel like we should get some compensation, but, at the same time, I understand there is a decline and a need for teachers and social workers and they deserve something, but so do we.

“It’s just not fair.”

Data taken from Griffith University’s Poverty on Placement report 2024 (Image: Jasmyn Evans).

The government does offer a Youth Allowance payment through Centrelink which allows students and Australian apprentices aged 18 to 24 and studying full-time to receive some financial help.

This fortnightly payment is means-tested and has strict eligibility requirements. If you’re classed as a dependant, your parents’ income is taken into account.

The current maximum payment for someone who is single with no children and lives at home is $472.50 a fortnight. The maximum payment when you need to live away from home for study or other circumstances is $663.30 a fortnight.

Stone says these payments should be enough to support most students despite the rising costs due to being indexed in line with the Consumer Price Index (CPI).

“[The payments] are adjusted by changes to the CPI every year. That certainly helps,” Stone says.

“But to the extent that the CPI is an average number, it will help on average.

“So, for students with different spending patterns, spending more on things whose prices have gone up faster than CPI, for example, it may not help as much.

“But the same goes the other way — for those students who spend most of their money on items rising at, or less than the CPI, they do well.”

When it comes to what could be done to help students manage the cost of living, Stone says more awareness of how to properly budget would be the best option.

“Many uni students have never been taught the basics of budgeting and don’t understand how to manage their finances,” she says.

University of South Australia Student Association (USASA) financial advisor Ivory Zhang offers a financial counselling service for UniSA students and has noticed the same lack of knowledge surrounding budgeting.

After working with nearly 400 domestic and international students, Zhang says budgeting is one of the biggest downfalls she sees in the students that access the service.

“Even [students] who come from, you know, a wealthy family, they still sort of don’t know how to budget themselves,” Zhang says.

“It seems like they don’t know how to live independently and how to, you know, adult financially.

“That’s one of the typical issues that I observe.”

Zhang says another prominent issue she encounters in students is a lack of financial literacy. A 2021 financial literacy study by Findex reported similar findings.

The survey found only half of young Australians aged 15 to 25 think they have a good understanding of managing their finances. It also found that while young people are financially literate when it comes to medium-term goals, they are less financially competent in managing day-to-day spending habits.

The report found the lack of budgeting to be a reoccurring theme, with 25 per cent of respondents saying they rarely or never set a budget. Another 26 per cent reported they only occasionally set budgets.

“Maybe, you know, they haven’t observed [how to budget] or their parents haven’t taught them, maybe they haven’t learned it from high school,” Zhang says.

“The basic cost of living and survival issue would always be combined with the budgeting issues.”

The financial counselling service offered by USASA allows students to work with an advisor and create an individualised budgeting plan based on their income and expenses.

What changes do students want to see?

Knox says the prices of essentials need to change for students to be able to thrive again.

“In order to be able to live, grocery and food prices need to come down,” he says

“I think that would help a lot.”

Students from Griffith University voted strongly for placements to become paid and for there to be more emphasis on demonstrating learning outcomes rather than meeting set hours.

Lim agrees with these changes, saying they would completely alter the experience of placement.

“There would be less financial burden, it creates a more positive placement experience, I probably wouldn’t be so mentally exhausted and burnt out, and I’d probably sleep better at night,” he says.

“Even though we’re students, we’re providing a service to other people, so it’s justified that we’re paid for that.”